At a Glance

- Policy change (Nov 1, 2025): China ended VAT input-tax credits when retailers sell gold bought from the SGE.

- This likely adds upward pressure on retail prices. Prices were already around CNY 1,160/g, straining affordability.

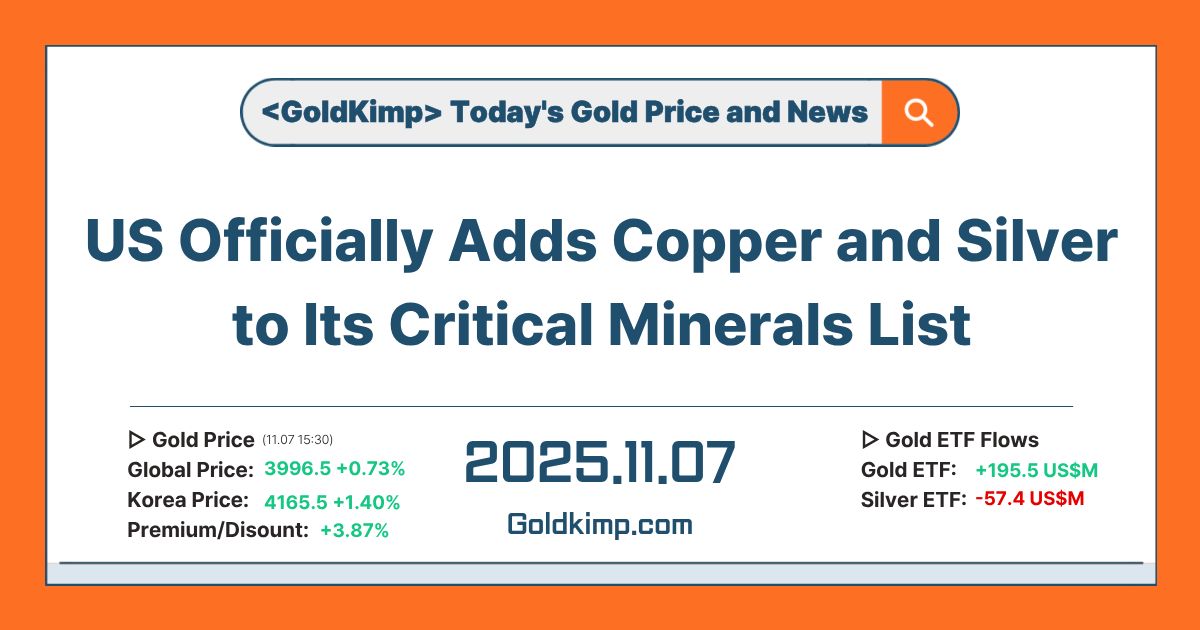

- In Q3 2025, global demand hit 1,313 t (+3% YoY) with ETF inflows of 222 t (~USD 26bn). Global prices are driven by ETF flows and macro factors (USD, rates, policy).

Is a China-led slowdown starting?

From Nov 1, 2025, retailers can no longer issue the dedicated VAT invoices to offset input VAT when selling SGE gold; sold as is or processed into bars/coins, jewelry.

Exchange-internal trades may be VAT-exempt, but after physical delivery at retail, no credit applies. This shifts cost structures across distribution, processing, and retail.

The loss of credits likely lifts final prices and dims near-term physical demand (jewelry, bars/coins).

China’s demand backdrop

In early Oct 2025, leading brand retail prices reached ~CNY 1,160/g (vs ~CNY 630/g in January), pointing to weaker purchasing power.

In Sep 2025, Chinese dealers quoted London discounts of $31–71/oz, signaling demand softness even before the tax change.

What drives global prices: ETF & macro

WGC (Gold Demand Trends Q3 2025): ETF inflows 222 t, bar/coin 316 t. Jewelry softened on high prices; central-bank buying stayed firm.

Total demand 1,313 t (+3% YoY, record). Global prices react more to ETF flows, liquidity, USD/rates, policy than to a single domestic policy in China.

Related Articles: WGC Q3 2025 Gold Demand: Key Takeaways

Conclusion

Ending the retail-stage VAT credit (Nov 1, 2025) likely pushes up Chinese retail prices and tempers near-term physical demand.

Yet global price direction remains more sensitive to ETF flows and macro factors (Fed policy, USD, rates), as the WGC Q3 2025 data suggest.