This article summarizes the World Gold Council (WGC)’s Gold Demand Trends Q3 2025 and highlights the key takeaways for Korean investors.

At a glance

- Total demand (incl. OTC): 1,313t (YoY +3%), a record high.

- ETF inflows: 222t, marking the largest-ever quarterly inflow by value (US$26B). Total holdings stood at 3,838t, about 2% below the all-time high.

- Physical investment (bars & coins): 316t, above 300t for the 4th straight quarter.

- Central banks (net purchases): 220t (QoQ +28%), with Kazakhstan and Brazil among the notable buyers.

- Jewelry: 371t (YoY −19%) by volume, but US$41B (YoY +13%) by value as higher prices lifted nominal spending.

- Supply: 1,313t (YoY +3%), a record high; mining 977t (YoY +2%), recycling 344t (YoY +6%).

Sector details

1) Investment (ETFs, bars/coins)

- ETFs: Quarterly inflows of 222t (US$26B) exceeded the previous 2020 record by value. Total holdings: 3,838t. Regional flows: North America +139t, Europe +70t, Asia +13t (strength in Japan/India, outflows in China).

- Bars & coins: 316t, the fourth consecutive quarter above 300t, driven by stronger retail investment in India, China, and other key markets.

2) Central banks

- Net purchases: 220t (+28% QoQ), above the 5-year average; key buyers included Kazakhstan (+18t), Brazil (+15t), Türkiye (+7t), and Guatemala (+6t).

- Interpretation: Central banks continue to view gold as a reserve diversification and risk-hedging asset.

3) Jewelry

- Volumes fell to 371t on price pressure, while value rose to US$41B. Both China and India saw lower volumes, though seasonality supported intra-quarter stabilization.

Key points for Korean investors

- Investment-led cycle

In 2025, the investment share (ETFs + bars/coins) has exceeded half of total demand, up from roughly one-third in 2024—signaling gold’s stronger role as a defensive/diversifying asset. - Structural central-bank buying

Despite high prices, cumulative purchases are running at ~643t YTD, below the last 3 years but well above the long-term average (≈400–500t per year). - Korea’s bars & coins

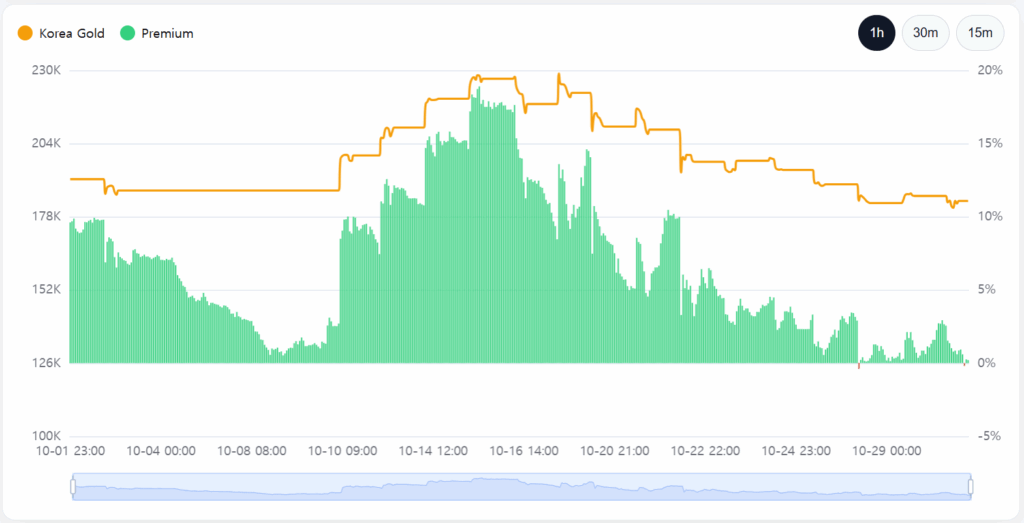

Q3 Korea: 5.9t (YoY +40%), with YTD at a record 18t. The price rally and weak KRW accelerated demand. Korea’s Gold Kimchi Premium (peaking near +20%) reflects the surge in physical buying.

Q&A

Q1. Which is better, gold ETFs or physical bars/coins?

A. ETFs offer trading and custody convenience; bars/coins provide tangible ownership and psychological comfort in stress periods. Consider fees, liquidity, and taxes and use a blended allocation.

Q2. Isn’t gold too expensive now – what about risk?

A. While jewelry demand shows price sensitivity, central-bank buying and ETF inflows have provided a firm downside cushion. Position sizing and rebalancing are key.

Disclaimer

This content is for information only based on WGC reports and public data and does not constitute investment advice. Final decisions and any gains/losses are solely your responsibility.

Source: World Gold Council, Gold Demand Trends Q3 2025.

![[URGENT] Gold-Silver Ratio Breaks Below 60!](https://goldkimp.com/wp-content/uploads/2025/12/gold-silver-ratio-hits-60-historic-low-image.jpg)