Gold Kimchi Premium in Korea: What Is It, Exactly?

These days you often see posts like this in the news or on investing forums:

“Gold kimchi premium is surging again…”

“ACE KRX Gold Spot is trading at a big premium…”

But in reality, there are very few articles that clearly explain what the “Gold Kimchi Premium” is, where to check it, and how to actually use it in your investing.

That’s why we created the “How to Use the Gold Kimchi Premium for Gold Investing” series (Parts 1/2/3).

This first part will focus on three core topics:

- What is the Gold Kimchi Premium and why does it occur?

- How is the Gold Kimchi Premium calculated?

- Where and how can you check the Gold Kimchi Premium (websites & tools)?

This article is written for gold-investing beginners, so feel free to follow along step by step.

1. What is the Gold Kimchi Premium?

The Gold Kimchi Premium shows, in percentage terms, how much more expensive (+) or cheaper (–) the domestic Korean gold price is compared to the international gold price.

International gold price

Usually quoted in USD as XAUUSD (the price per 1 troy ounce of gold).

✅ GoldKimp Comment:

XAU is the ISO 4217 code representing 1 troy ounce of gold. XAU/USD is the currency pair that shows the price of 1 troy ounce of gold in U.S. dollars, and is widely used in FX and CFD markets to trade gold. In the code, “X” indicates a special asset or unit that does not belong to a specific country, while “AU” comes from “Au”, the chemical symbol for gold in the periodic table.

Domestic Korean gold price

Typically, this refers to the KRX Gold Spot price (quoted per 1 g) listed on the Korea Exchange (KRX).

Gold Kimchi Premium

When you convert these two prices to the same unit and currency and compare them, the Korean gold price may be higher or lower than the international price.

– If Korea is more expensive, you see a positive (+) premium.

– If Korea is cheaper, you see a negative (–) premium (discount).

✅ GoldKimp Comment:

In India, where physical gold trading is extremely active, the local gold price also often trades above or below the international price. This gap is commonly referred to as the Indian gold premium or discount.

2. Why does the Kimchi Premium occur?

Let’s briefly look at the main reasons.

Exchange rate effects

The international gold price is quoted in USD, while the domestic price is in KRW. When the USD/KRW exchange rate spikes or drops sharply, the KRW-converted value of the international gold price also moves significantly. During this adjustment process, any difference in how quickly the exchange rate is reflected can cause the Gold Kimchi Premium to widen temporarily.

Differences in tax and regulations

Each country has its own rules for VAT, capital gains tax, and fee structures on gold transactions. In Korea, for example, KRX Gold Spot is exempt from capital gains tax under certain conditions, so when demand concentrates in this product, domestic gold can structurally tend to trade at a premium to the international price.

Supply–demand and investor sentiment

Gold is often viewed as a form of “insurance” during times of uncertainty. When issues such as geopolitical risks, financial instability, or a sharp rise in the exchange rate arise, Korean investors may rush into KRX Gold Spot. This can cause domestic gold prices to spike disproportionately compared to the international market.

Time difference, transaction costs, and market frictions

In theory, you might think: “If gold is too expensive in Korea, just buy gold abroad and sell it here. Easy arbitrage.” But in reality, this is almost impossible for individual investors because you run into real-world frictions:

- FX spread and costs (KRW–USD conversion fees + FX risk)

- Brokerage and product fees for foreign products (ETF and futures trading fees, spreads, etc.)

- Different tax systems and regulations across countries

- Time zone and trading hours mismatch (Korea vs overseas markets)

Because of these frictions, a price gap that should theoretically be arbitraged away still remains in practice as a persistent spread or deviation, usually expressed as a premium/discount. The Gold Kimchi Premium is simply a way to quantify this gap in numbers.

✅ GoldKimp Comment:

The term “Kimchi Premium” originally comes from the 2017–2018 Bitcoin bull market. During that time, Bitcoin on Korean exchanges traded significantly higher than on overseas exchanges, and Korean communities started calling this gap the “Kimchi Premium”, often shortened to “김프” (Kim-P). That expression has since become widely used.

3. How is the Korean Gold Kimchi Premium calculated?

It may look a little math-heavy at first, but once you see the process, it is actually quite straightforward.

(1) Step-by-step formula

- Convert the international gold price ($/oz) into KRW per gram (Won/g)

International gold price: XAUUSD (USD/oz)

Exchange rate: USDKRW (KRW/USD)

1 troy ounce = 31.1034768 g

International gold price (KRW/g) = XAUUSD × USDKRW ÷ 31.1034768

- Domestic gold price (KRW/g)

Simply use the KRX Gold Spot quote per 1 g.

- Gold Kimchi Premium

Gold Kimchi Premium (%)

= (Domestic gold price (KRW/g) ÷ International gold price (KRW/g) – 1) × 100

(2) Example calculation

- International gold price: 2,000 USD/oz

- Exchange rate: 1,400 KRW/USD

- International gold price (KRW/g):

2,000 × 1,400 ÷ 31.1034768 ≈ 90,000 KRW/g (rounded) - Domestic gold price: KRX Gold Spot 1 g = 95,000 KRW (assumed)

- Gold Kimchi Premium (%)

= (95,000 ÷ 90,000 – 1) × 100

= 5.55%

Interpretation:

KRX Gold Spot in Korea is currently trading at about 5.55% more expensive than the internatiInterpretation: KRX Gold Spot in Korea is currently trading at about 5.55% more expensive than the international gold price.onal gold price.

4. Where and how can you check the Gold Kimchi Premium?

(1) How to check KRX Gold Spot prices

On your brokerage app (MTS/HTS), simply search for “KRX Gold Spot” to see the 1 g price quoted on the Korea Exchange.

(2) How to check the international gold price

On a portal site, search for “XAUUSD” or “Gold price”, or use the overseas futures/commodities section in your brokerage platform to see the international gold price quoted in USD/oz.

(3) How to check the exchange rate

On a portal, search for “USDKRW” or “today’s exchange rate,” or visit the FX section in your brokerage app to see the latest USD/KRW rate.

With these three numbers, you can manually calculate the Gold Kimchi Premium. However, doing this calculation each time is quite tedious.

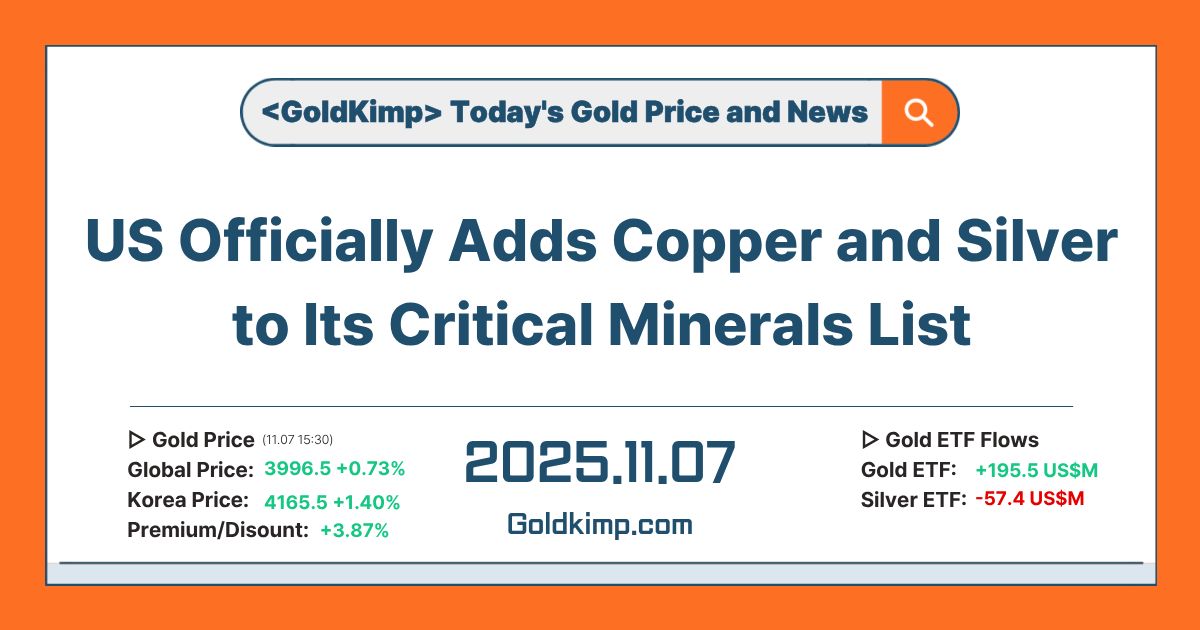

That’s why it’s simpler to use a site that automatically tracks the Gold Kimchi Premium, such as GoldKimp.com .

(4) Real-time Gold Kimchi Premium on GoldKimp.com

To save you time and effort, GoldKimp.com provides the following on a single screen:

- Domestic KRX Gold Spot price

- International gold price in USD/oz and the converted KRW/g value

- Real-time USD/KRW exchange rate

- Gold Kimchi Premium (%) between the two prices

- A 10-year historical chart of the Gold Kimchi Premium (for long-term trends)

Without any manual calculations, you can simply visit the Gold Kimchi Premium page on GoldKimp.com to see at a glance how expensive or cheap Korean gold currently is vs. international gold.

5. Custom Gold Premium Calculator

If you prefer to plug in your own numbers, you can use the Gold Premium Calculator widget on the site.

Just enter:

- Global gold price (USD/oz)

- Korea gold price (KRW/g)

- Exchange rate (USD/KRW)

Then click the “Calculate Premium” button, and the Gold Premium (spread/deviation %) under your chosen conditions will be calculated automatically.

Gold Premium Calculator

6. One-sentence summary

“The Gold Kimchi Premium shows how much more expensive or cheaper KRX Gold Spot is compared to the international gold price. All you need are three figures—domestic gold price, international gold price, and the exchange rate—to calculate it yourself, or you can simply check real-time values and long-term trends on GoldKimp.com without doing any math.”

Series overview

[How to Use the Gold Kimchi Premium for Gold Investing – Series Guide]

- Part 2 will cover how to actually choose between domestic and overseas gold investment options, including:

- Suggested portfolio allocation to gold (how much % based on insights from legendary investors)Overview of domestic gold investment productsOverview of overseas gold investment productsNet profit comparison between KRX Gold Spot and US gold ETFs such as GLD (after fees and taxes)

- Part 3 will finally dive into practical strategies that directly use the Gold Kimchi Premium, including:

- Is arbitrage using the Gold Kimchi Premium really possible?

- Gold Kimchi Premium Switching Strategy v1.0 (a practical method to increase your gold holdings in grams with the same principal)

- Hidden risks and pitfalls in Kimchi Premium strategies

- The concept of a “critical premium level” for gold

Please stay tuned for the next article, and thank you for reading to the end.