How Is the Gold Price Determined?

The international gold price is formed in real time by supply and demand in global spot and futures markets. Major venues include London (OTC) and New York (COMEX), typically quoted as XAU/USD (US dollars per troy ounce).

In most cases, the international price moves first, and Korea’s domestic gold price reflects it after passing through the exchange rate (USD/KRW) and local market conditions.

View live prices → Real-Time Gold Price

Why Do International and Domestic Prices Differ?

International (USD/oz) and domestic (KRW/g) use different units and operate in different market structures, so gaps (premium/discount) can occur.

- FX effect: Converting USD quotes into KRW introduces volatility.

- Taxes/fees: VAT, trading & storage fees, shipping & insurance, etc.

- Spread: Bid–ask differences and tick sizes.

- Brand/form premium: Small bars/coins and certain brands command extra premiums.

- Trading hours & time lag: Update timing differs between global and domestic markets.

- Domestic supply & hedging costs: Inventory tightness and higher hedging/financing costs can move local prices.

As these factors overlap, a gap emerges between the theoretical KRW price (simple conversion) and the actual domestic transaction price (KRW/g).

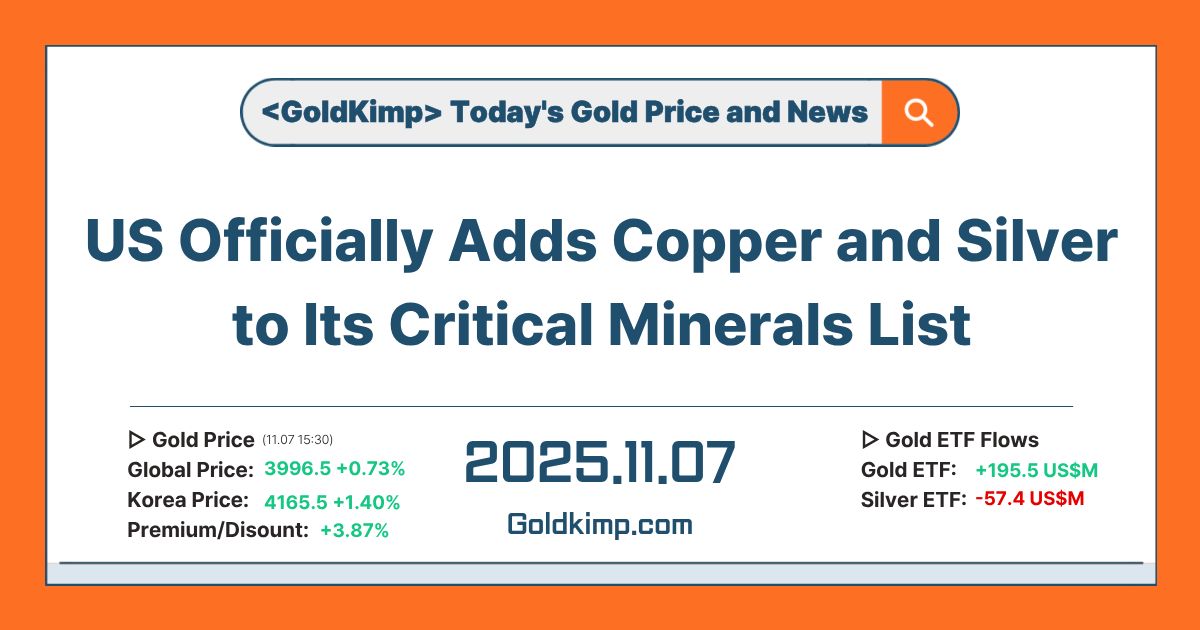

What Is the Gold Kimchi Premium?

The Gold Kimchi Premium measures the difference between the theoretical price (KRW/g) and the domestic transaction price (KRW/g) described above.

- Positive (+): Domestic price is relatively higher (premium).

- Negative (–): Domestic price is relatively lower (discount).

In sharp short-term moves, the international price and FX often adjust first, and the domestic price catches up with a time lag.

See the premium now → Gold Kimchi Premium Chart

How to Calculate the Gold Kimchi Premium

Theoretical price (KRW/g) = International price (USD/oz) × FX (KRW/USD) ÷ 31.1035 ※ 1 troy ounce (oz) = 31.1035 g

Kimchi Premium (%) = (Domesticprice(KRW/g)–Theoreticalprice(KRW/g))÷Theoreticalprice(KRW/g)(Domestic price (KRW/g) – Theoretical price (KRW/g)) ÷ Theoretical price (KRW/g)(Domesticprice(KRW/g)–Theoreticalprice(KRW/g))÷Theoreticalprice(KRW/g) × 100

Example

- International price = 3,000 USD/oz

- FX = 1,400 KRW/USD

- Theoretical price = 3,000 × 1,400 ÷ 31.1035 ≈ 135,033 KRW/g

- Domestic price = 140,000 KRW/g

- Gold Kimchi Premium (%) = (140,000 – 135,033) ÷ 135,033 × 100 ≈ 3.68%

Main Drivers of the Gold Kimchi Premium

- Rapid FX moves: A stronger USD lifts KRW-converted prices and can distort the premium.

- Tight physical supply in Korea: Low inventories or import delays can push domestic prices higher.

- Trading hours & time lag: Delay between international/FX moves and domestic reflection.

- Wider spreads: During volatility, quotes widen and executions can skew.

More

Gold Kimchi Premium Chart

Silver Kimchi Premium Chart

Historical Returns: Gold & Silver

Gold–Silver Ratio Chart