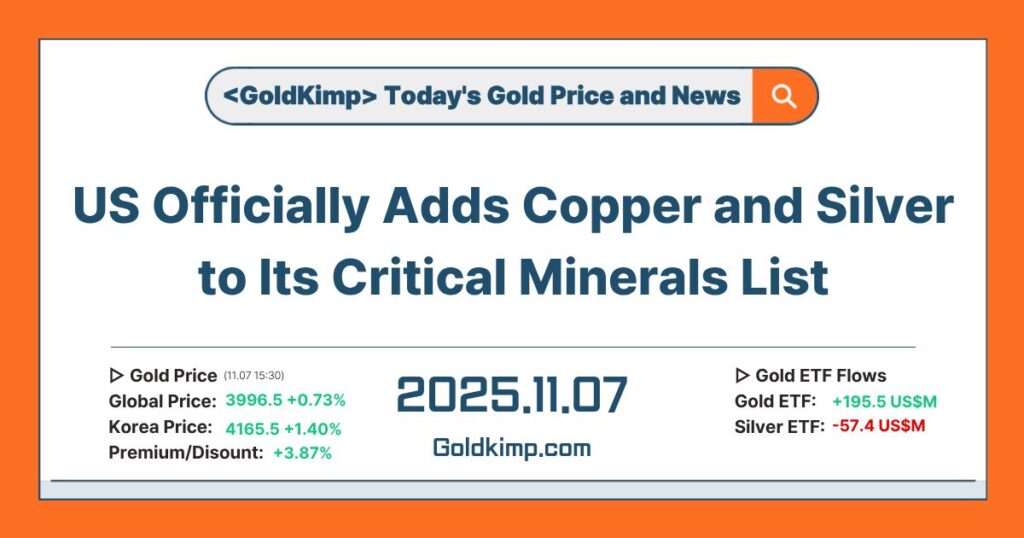

Today’s Gold Prices

🌐 Global gold price: 3,996.5 +0.73%

🇰🇷 Korea gold price: 4,165.5 +1.40%

Premium/Discount: +3.87%

🌐 Global silver price: 48.4 +1.42%

🇰🇷 Korea silver price: 57.6 +0.97%

Premium/Discount: +19.01%

💵 USD/KRW: 1,456.57

(2025.11.06 15:30 KST)

Global ETF Flows

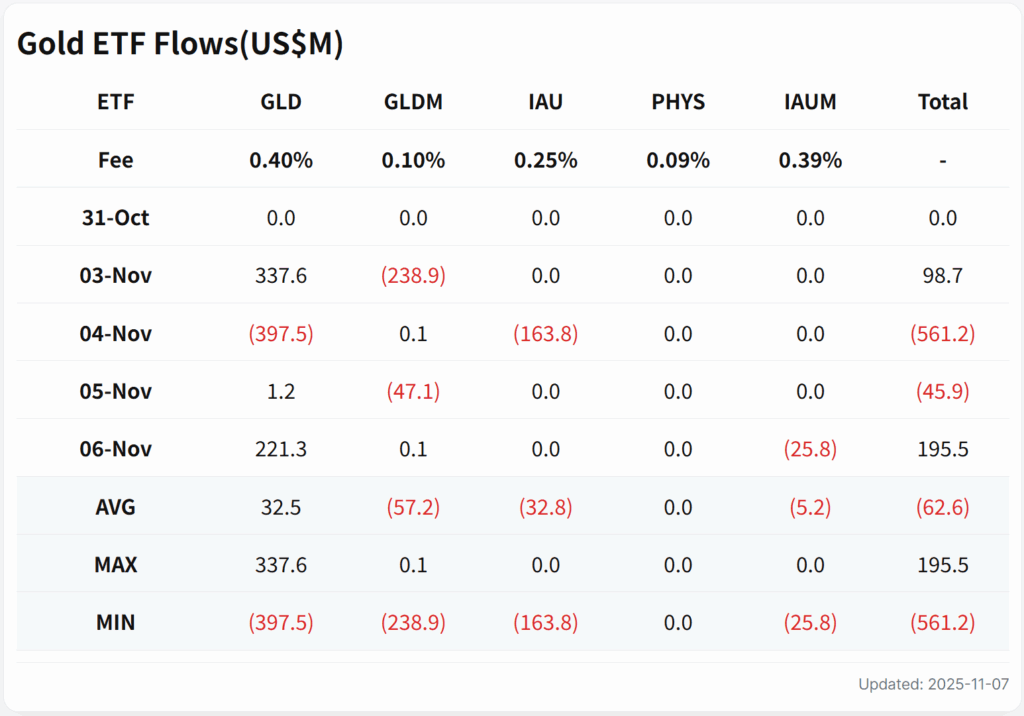

Gold ETF Flows

As of November 6, GLD saw a net inflow of $221.3M, GLDM a net inflow of $0.1M, and IAUM a net outflow of $25.8M. Across the five gold ETFs, the total net inflow was $195.5M.

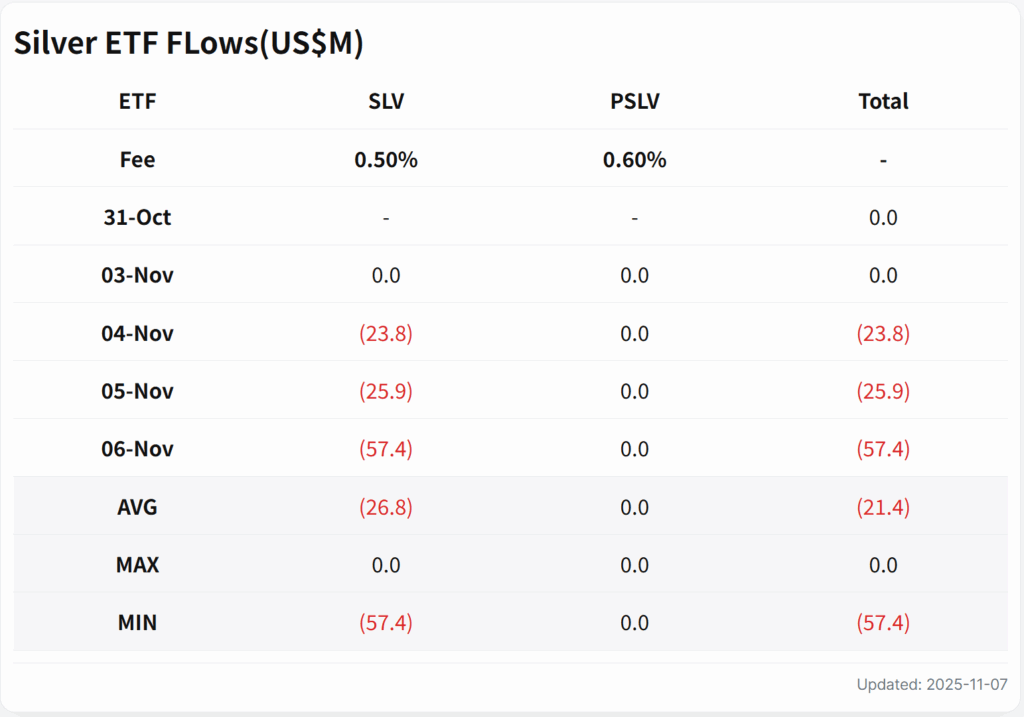

Silver ETF FLows

Looking at U.S. silver ETF flows as of November 6, SLV recorded a net outflow of $57.4M. Across the two silver ETFs, the total net outflow was $57.4M.

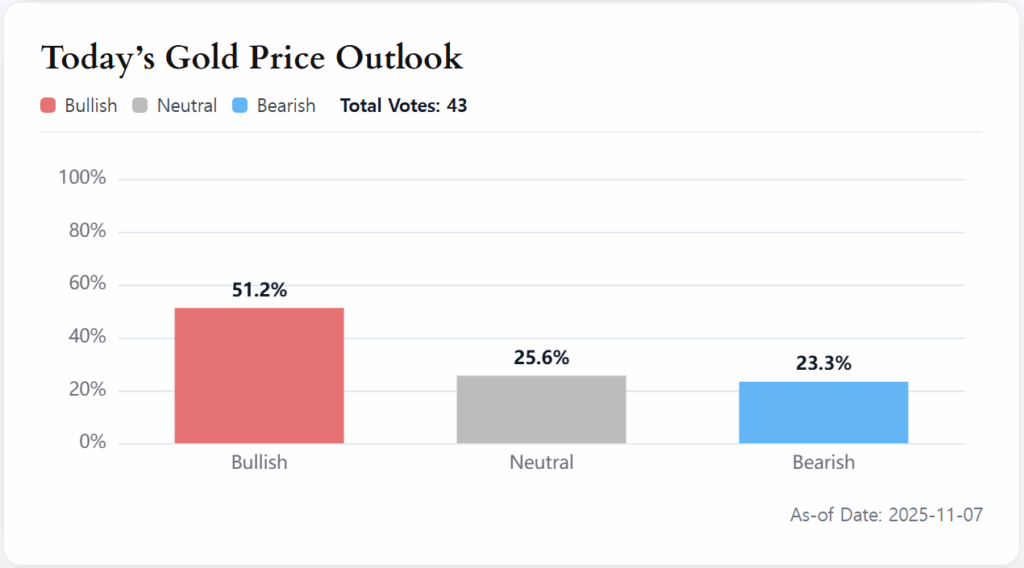

Today’s Gold Market Sentiment

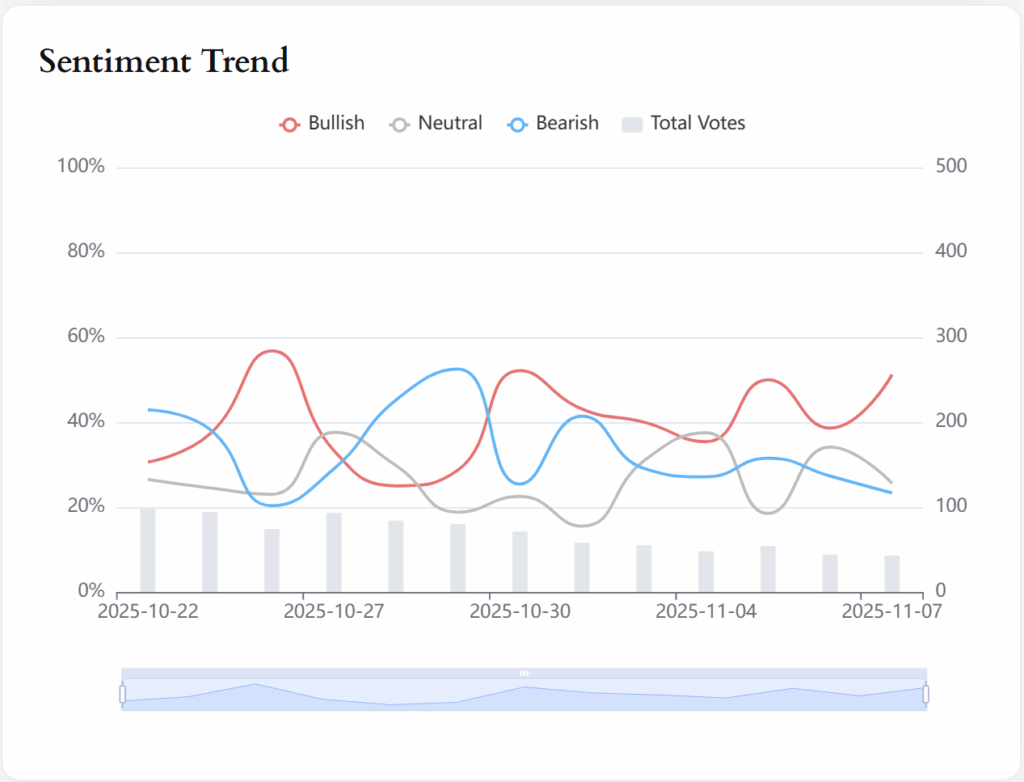

Today’s gold-market sentiment was predominantly positive, with “bullish” at 51.2%. Korea’s KRX spot gold also finished higher.

Top Gold News

📌 United States, officially adds copper and silver to the “critical minerals” list

The United States has added copper and silver to its list of critical minerals—resources deemed essential to the economy and national security. The new USGS list expands the 2022 roster by 10 minerals to a total of 60, adding uranium, metal tin, potassium, rhenium, silicon, and lead, among others. Built on an economic model that estimates the potential impact of foreign trade disruptions, the list aims to give policymakers a more realistic and useful framework. It also underpins tax incentives and resource-recovery investments proposed by the Trump administration.

📌 Is gold a bubble—or still in an uptrend? Jim O’Neill sees cases for both

With gold swinging around ~$4,000/oz, noted British economist Jim O’Neill presents persuasive arguments for both upside and downside. He says gold prices can fluctuate with economic uncertainty and shifts in monetary policy, urging investors to analyze the data carefully. In this environment, gold could again stand out as a safe asset.

📌 ING’s Mantei expects a new gold price record in Q1 2026

Gold has struggled to hold above $4,000/oz. Even so, one financial institution expects a renewed upswing in the first quarter of next year. While acknowledging uncertainty, the outlook remains constructive, with attention on whether gold can set a new record high.

📌 Montage Gold boosts resources at the Koné Project in Côte d’Ivoire

According to the company’s latest exploration update, both measured & indicated and inferred resources have increased. The Koné Project now holds 269 million tonnes at 0.63 g/t Au (M&I), up 13% from the 2024 feasibility study. Inferred resources rose 76% to 43 million tonnes, containing 704,000 oz of gold. Montage plans to spend about US$18 million on exploration this year and aims to outline over 1 million additional ounces ahead of a 2027 production target. The project is progressing quickly and within budget, with 52 targets identified over 1,318 km².

![[URGENT] Gold-Silver Ratio Breaks Below 60!](https://goldkimp.com/wp-content/uploads/2025/12/gold-silver-ratio-hits-60-historic-low-image.jpg)