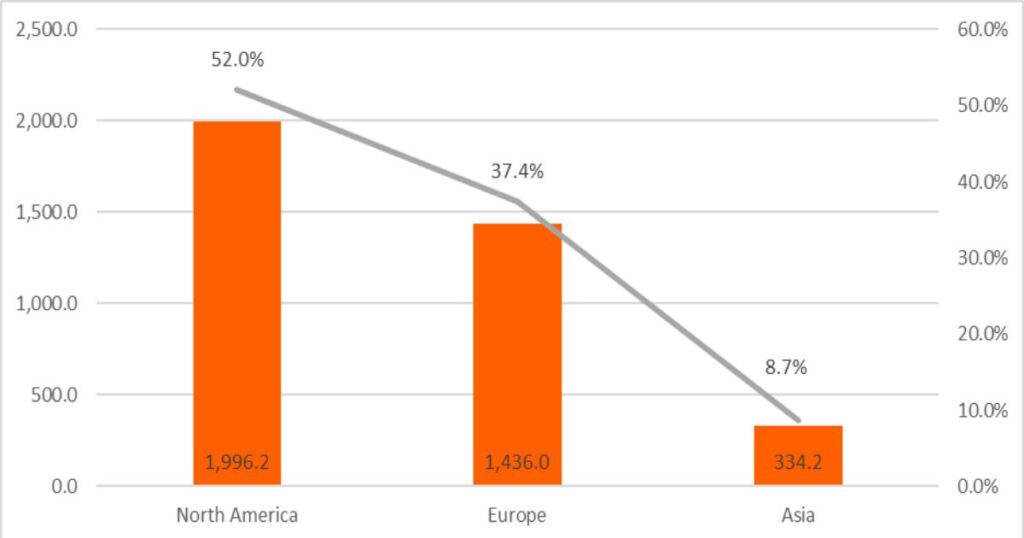

According to World Gold Council (WGC) data, global gold ETFs held a total of 3,837.7 tonnes of gold as of 30 September 2025. In this article, we analyze regional weights and the gold holdings of major gold ETFs in North America, Europe, and Asia based on this dataset to provide a clear snapshot of the global gold ETF landscape.

1. Gold ETF holdings by region

North America dominates, Europe follows, Asia is just beginning

Let us start with the regional totals:

- North America: 1,996.2 tonnes (share 52.0%)

- Europe: 1,436.0 tonnes (share 37.4%)

- Asia: 334.2 tonnes (share 8.7%)

- Global total: 3,837.7 tonnes (share 100%)

More than half of all gold held by global gold ETFs is concentrated in North America. Gold ETFs as a product first gained traction in the U.S. market, and mega-funds such as GLD and IAU have attracted capital for many years. As a result, the current market structure is clearly tilted toward North America.

Europe’s share of 37.4% is also significant. A wide range of gold ETFs is listed across traditional gold trading hubs such as London and Zurich, and demand from institutions and pension funds remains steady.

By contrast, Asia’s share is just 1.9%. In absolute terms this looks small, but considering that many investors in the region still prefer physical gold and bank gold passbooks, the gradual shift toward ETFs suggests ample room for growth in the coming years.

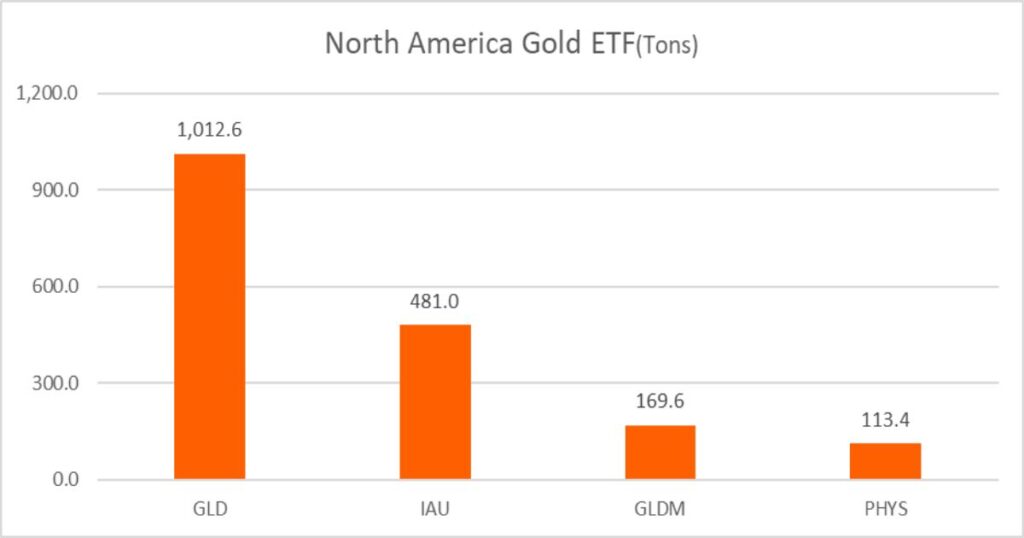

2. Key North American gold ETFs: GLD and IAU lead the market

The main gold ETFs representing North America and their gold holdings are:

- GLD (US): 1,012.6 tonnes

- IAU (US): 481.0 tonnes

- GLDM (US): 169.6 tonnes

- PHYS (US): 113.4 tonnes

A single ETF, GLD, accounts for a substantial share of global gold ETF holdings. With 1,012.6 tonnes of gold, it is by far the largest physical gold holding among ETFs and effectively functions as the “global benchmark gold ETF.”

IAU, with 481.0 tonnes, is GLD’s strong number two. By offering a relatively lower expense ratio, it has attracted a broad range of long-term investors, including retail and some institutional money. GLDM and PHYS are smaller in size but differentiate themselves through fee structures, custody arrangements, and tax treatment, thereby expanding investors’ choices within the North American gold ETF market.

For investors, instead of simply thinking “gold ETF = GLD,” it is important to compare fees, tax treatment, liquidity, and bid–ask spreads and then choose among GLD, IAU, GLDM, and PHYS according to individual needs.

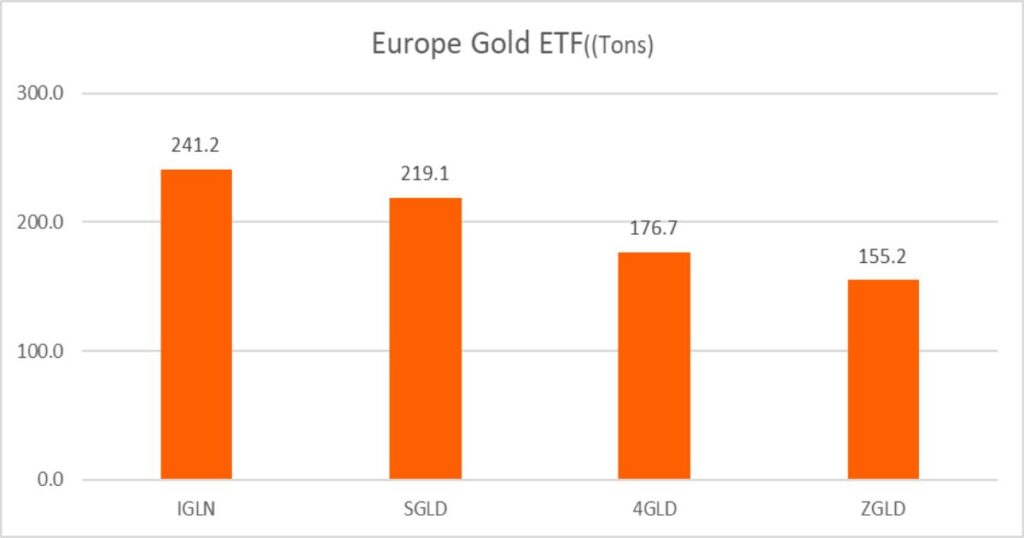

3. Key European gold ETFs: IGLN, SGLD, 4GLD, ZGLD in a decentralized structure

Major European gold ETFs and their gold holdings are:

- IGLN (UK): 241.2 tonnes

- SGLD (UK): 219.1 tonnes

- 4GLD (Germany): 176.7 tonnes

- ZGLD (Switzerland): 155.2 tonnes

While North America is dominated by a few mega-ETFs, Europe has a more decentralized structure, with assets spread across several countries and listing venues. London-listed IGLN and SGLD are the top two, followed by Germany’s 4GLD and Switzerland’s ZGLD.

Because European gold ETFs trade in multiple currencies, including the euro, pound sterling, and Swiss franc, base currency and hedging policy are key factors in investment decisions. For investors living in Europe or holding European-currency assets, these European ETFs can be valuable tools when combined with U.S. dollar-based ETFs from North America.

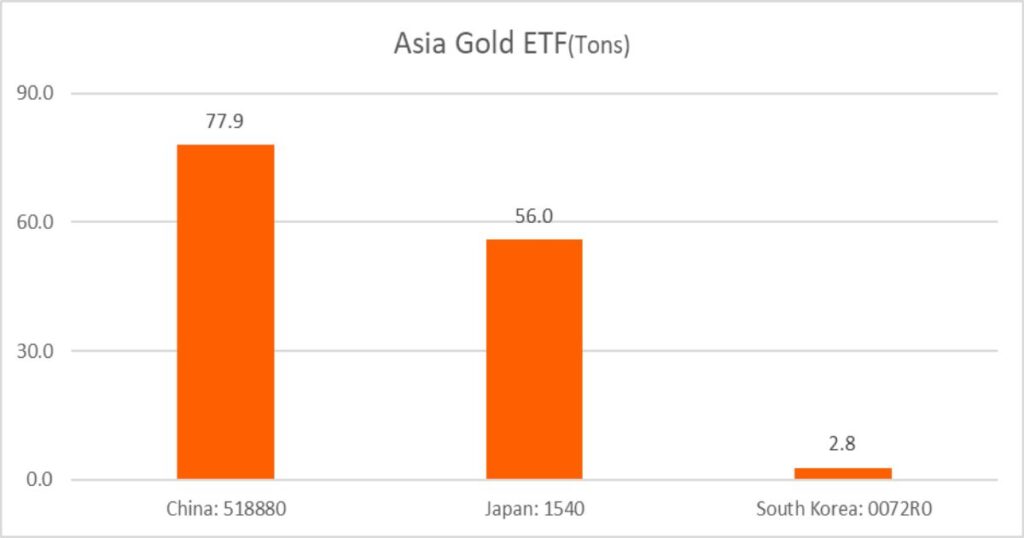

4. Key Asian gold ETFs: led by China and Japan, with Korea just getting started

In Asia, the standout ETFs are those from China, Japan, and Korea:

- China: 518880 (China P.R. Mainland) – 77.9 tonnes

- Japan: 1540 (Japan) – 56.0 tonnes

- Korea: 0072R0 (South Korea) – 2.8 tonnes

China’s 518880 and Japan’s 1540 are the flagship gold ETFs in their respective domestic markets. Although Asia’s overall share is still small, investors accustomed to physical gold and gold passbooks are gradually shifting toward ETFs, so Asia’s weight in WGC statistics could rise over time.

In Korea, gold ETF 0072R0 is listed but holds only 2.8 tonnes so far. However, given the presence of the KRX gold spot market and strong domestic preference for gold, the Korean gold ETF market has considerable potential, especially if tax rules and fee structures become more favorable.

5. What this means for investors

From the four charts based on WGC data as of 30 September 2025, we can draw three key takeaways:

- North America remains the core of the global gold ETF market. Mega-funds such as GLD and IAU lead the market, and over half of all gold held by gold ETFs is in the U.S.

- Europe has multiple strong players in a diversified structure. IGLN, SGLD, 4GLD, ZGLD and others provide various options across different countries and currencies for investors seeking regional and currency diversification.

- Asia is still small but has strong growth potential. Although the gold holdings of Chinese, Japanese, and Korean ETFs are limited, the region’s strong preference for gold suggests room for significant expansion over the long term.

Anyone considering gold investment should look not only at the gold price, but also at which ETFs hold how much gold. Gold ETF holdings show the direction of capital flows and indirectly reflect how investors in each region are using gold in their portfolios.

All figures in this article are based on global gold ETF holdings data released by the World Gold Council as of 30 September 2025, which have been reorganized by region and by major ETF. Before making any investment decisions, be sure to check the latest disclosures, fee schedules, exchange-rate movements, and tax rules for each ETF. This material is for information only and does not constitute investment advice.

📈 Gold Analysis

![[URGENT] Gold-Silver Ratio Breaks Below 60!](https://goldkimp.com/wp-content/uploads/2025/12/gold-silver-ratio-hits-60-historic-low-image.jpg)